annual gift tax exclusion 2022 irs

We expect the IRS to release official figures near year-end. The IRS has announced that the annual gift exclusion will rise to 16000 for calendar year 2022.

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022 Tesfaye Law

The IRS also increased the annual exclusion for gifts to 16000 in 2022 up from 15000.

. The gift tax exclusion for 2022 is 16000 per recipient. For 2022 the annual gift exclusion is being increased to 16000. According to the Wolters Kluwer projections in 2022 the gift tax annual exclusion amount will increase to 16000 currently 15000 per donee.

The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018. The annual gift tax exclusion was indexed for inflation as part of the Tax Relief Act of 1997 so the amount can increase from year to year to keep pace with the economy but only in increments of 1000. In 2022 the annual exclusion is 16000.

For example assume that in 2022 you give gifts totaling 16000 to each your three children for a total of 48000. In 2018 2019 2020 and 2021 the annual exclusion is 15000. The federal estate tax exclusion is also climbing to more than 12 million per individual.

Two things keep the IRSs hands out of most peoples candy dish. The federal estate tax exclusion is also climbing to. 2022 Annual Gift Tax and Estate Tax Exclusions Increase.

The annual exclusion applies to gifts to each donee. 2022 annual gift tax and estate tax exclusions increase january 25 2022 the amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018. After four years of being at 15000 the exclusion will be 16000 per recipient for 2022the highest exclusion amount ever.

Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax-free without using up. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or less to any one individual anyone other than their spouse does not have to report the gift or gifts to the IRS. Gifts That Dont Require Reporting.

The individual and his or her spouse wish to split all gifts made by each other during the calendar year. In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift. The annual exclusion amount for 2021 is 15000 and 16000 for 2022.

The 10000 to Bob qualifies for the annual exclusion a total of 2000 to Susie qualifies for the annual exclusion and a total of 50000 to your spouse. You can give up to 15000 worth of money and property to any individual during the year without any estate or gift tax consequences. The annual exclusion for gifts is 11000 2004-2005 12000 2006-2008 13000 2009-2012 and 14000 2013-2017.

This might be done in a single gift to each child or a series of gifts so long as the annual total to each child is not greater than. November 16 2021. There are a few exceptions the IRS makes on what can be considered a taxable gift.

This is of particular interest to families with special needs because the ABLE contribution cap is tied to the annual gift tax exclusion meaning that the. The federal estate tax exclusion is also climbing to more than 12 million per individual. In 2021 the exclusion limit is 15000 per recipient and it rises to 16000 in 2022.

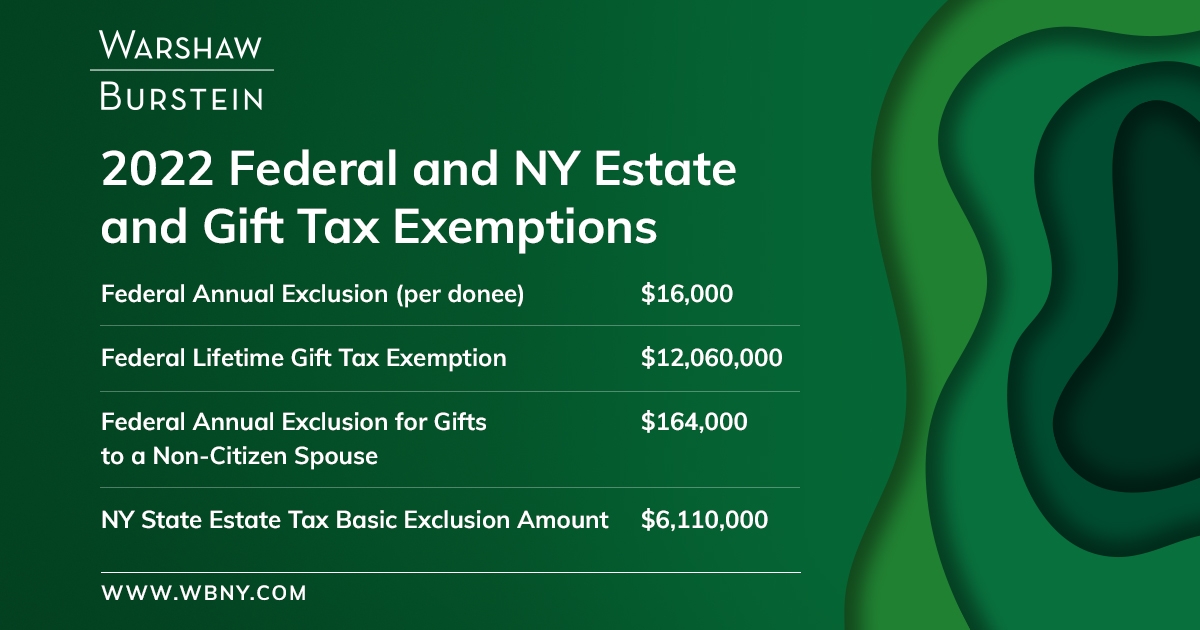

The amount you can gift without filing a tax return is increasing to 16000 in 2022 the first increase since 2018. Thats up from 117 million in 2021 1158 million in 2020 and 114 million in 2019. The 2022 federal estate and gift tax exemption has been increased to 12060000 up from 11700000 in 2021.

The amount an individual can gift to any person without filing a gift tax return has remained at 15000 since 2018. This increase to the federal estate and gift exemption amount to 12060000 means that estates of individuals who die in 2022 with combined. The total value of gifts the individual gave to at least one person other than his or her spouse is more than the annual exclusion amount for the year.

1 That means if you had the money you could whip out your checkbook and write 16000 checks to your mom your brother your sister your new best friends youll have lots of friends if you start giving away free money and you wouldnt have to pay a gift tax. For 2022 the lifetime exclusion is 1206 million. The estate and gift tax lifetime exemption amount is projected to increase to 12060000 currently 11700000 per individual.

Each year you can gift amounts up to the annual exclusion limit without filing a gift tax return or paying taxes on the gift. The annual exclusion for 2014 2015 2016 and 2017 is 14000. You have made total gifts of 62000 in 2022 but fortunately for you all of them qualify as annual exclusion gifts or are not taxable per the unlimited marital deduction.

Annual Gift Tax Exclusion 2022For 2022 the annual exclusion is 16000 per person up from 15000 in 2021. The annual exclusion 15000 in 2021 and 16000 in 2022 and the lifetime exclusion 117 million in 2021 and 1206 million. The gift tax limit for individual filers for 2021 was 15000.

The annual exclusion for 2021 is 15000 per individual recipient and for 2022 is 16000 per individual recipient. It increases to 16000 for 2022. The first tax-free giving method is the annual gift tax exclusion.

The annual gift exclusion is applied to each donee. Any person who gives away. For 2018 2019 2020 and 2021 the annual exclusion is.

The IRSs announcement that the. Annual Gift Tax and Estate Tax Exclusions Rise in 2022. Marshall Parker Weber.

Generally the following gifts are exempt. If you are married you and your spouse can make combined gifts up to 32000 per person in 2022. The Annual Gift Tax Exclusion for Tax Year 2022.

The Internal Revenue Service has announced that the annual gift tax exclusion is increasing next year due to inflation.

Make Note Of These Estate And Gift Tax Exemption Amounts For 2022 Preservation Family Wealth Protection Planning

Gift Tax How Much Is It And Who Pays It

Planning For Year End Gifts With The Gift Tax Annual Exclusion Doeren Mayhew Cpas

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Inflation Updates For 2022 Federal Estate And Gift Tax

Taxes 2022 7 On Your Side United Way Answer Viewer Questions During Tax Chat Abc7 San Francisco

Annual Gift Tax Exclusion Vs Medicaid Look Back Period Cornetet Meyer Rush Stapleton

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

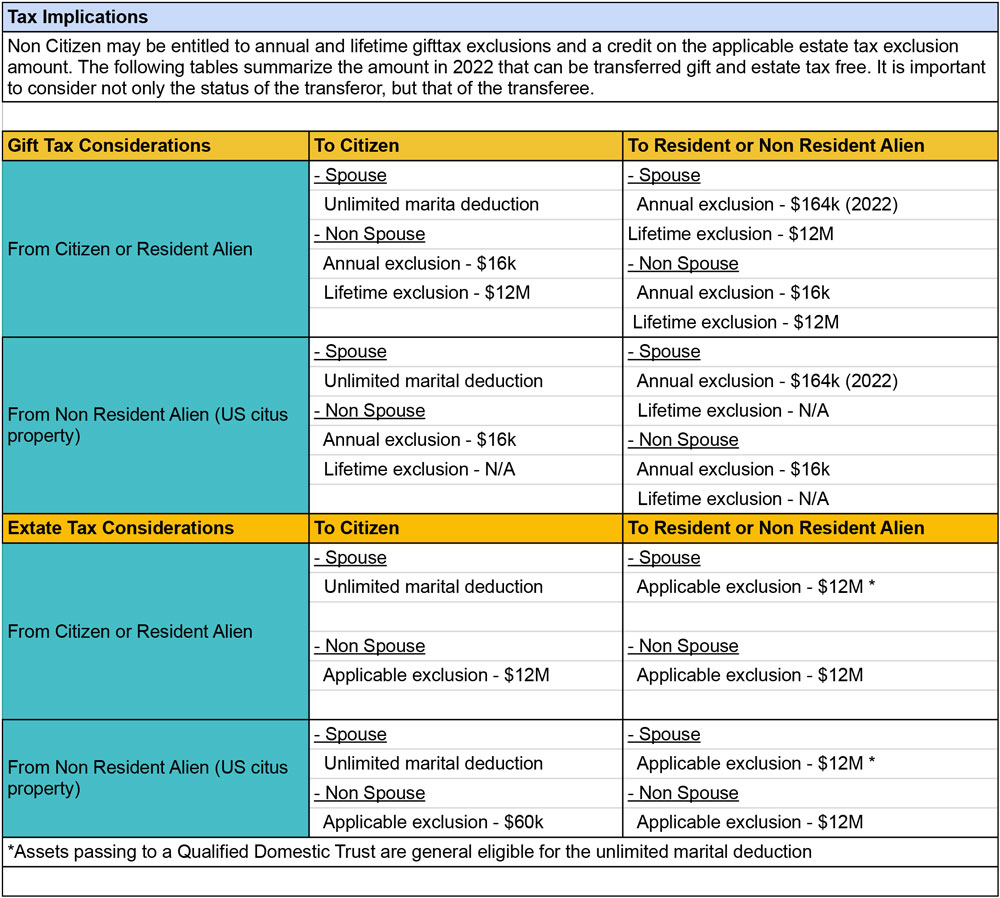

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Advanced American Tax

How To Make The Most Of The Annual Gift Tax Exclusion Cpa Firm Tampa

Warshaw Burstein Llp 2022 Trust And Estates Updates

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Irs Increases Annual Exclusion For Gifts For Calendar Year 2022 Kruggel Lawton Cpas